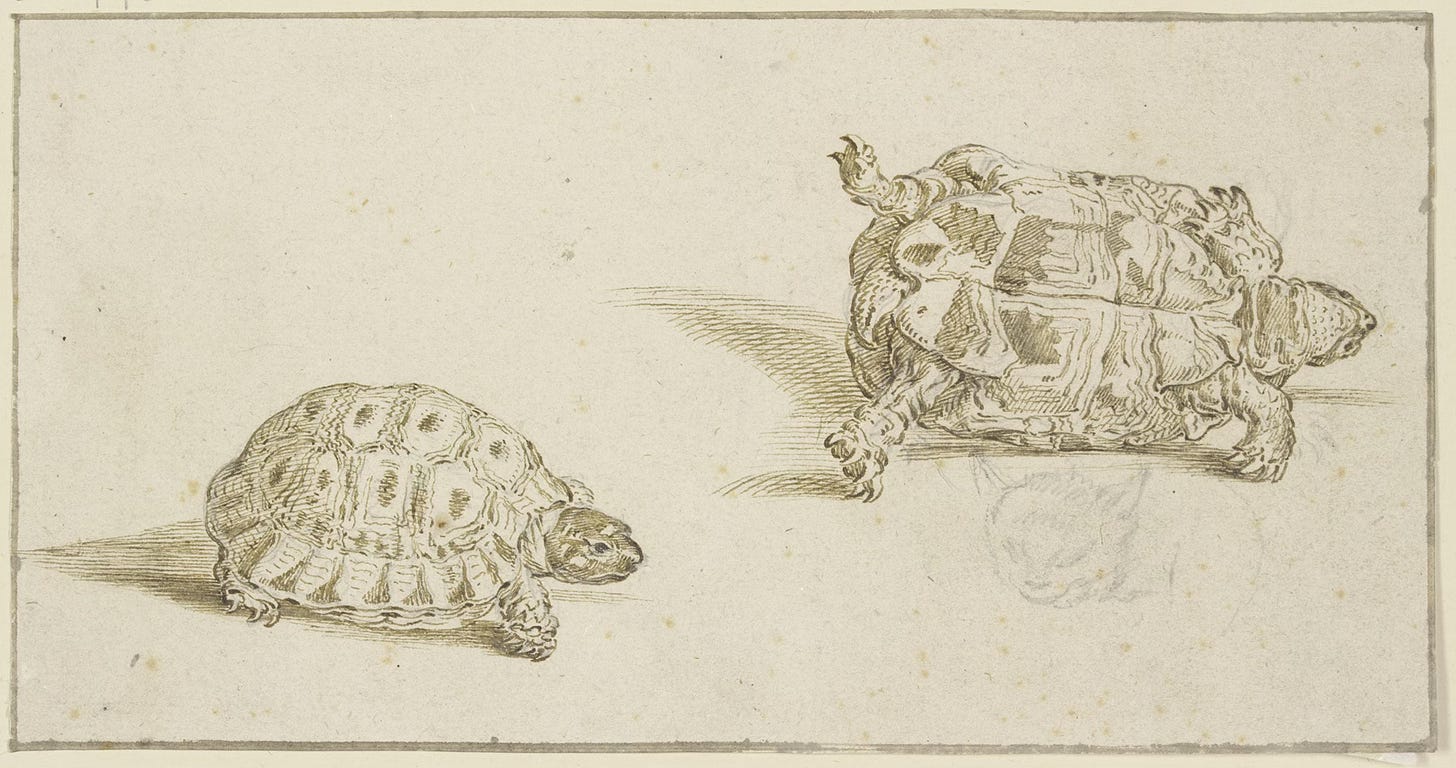

Today’s post comes from our friend James Vermillion, who is working on a book of charming Carrollian dialogues exploring money, markets, and belief. Here, Achilles and the Tortoise grapple with probabilistic thinking and the stubborn limits of predictability. For more from James, check out his website, where he explores philosophy, freedom, science, and whatever else captures his curiosity.

I.

Achilles: (confidently scrolling through charts on his tablet) Tortoise, I’ve cracked the code! My new predictive model accounts for every conceivable market scenario. I’ve backtested everything from the Tulip Mania to the GameStop squeeze.

Tortoise: (raising an eyebrow) Every conceivable scenario? My, what a comprehensive imagination you must have.

Achilles: It’s not imagination, it’s mathematics! Fifty years of data, seventeen different asset classes, forty-three statistical factors. I’ve modeled crashes, bubbles, corrections, recoveries, and even those pesky “black swan” events everyone keeps nattering about.

Crab: (scuttling closer with evident amusement) Your “Black swan” events seem to waddle through the markets with suspicious regularity, I notice.

Achilles: Exactly why I’ve tamed them with proper quantification! Look, let me demonstrate the elegance of probability theory with something beautifully simple.

Achilles pulls out a coin.

Achilles: This humble coin embodies perfect binary probability. Heads or tails, 50-50, elegantly predictable over any meaningful sample size.

Tortoise: (dryly) How refreshingly straightforward. A universe of exactly two possibilities.

Achilles: Precisely! And if we can model this simple system flawlessly, surely we can conquer more complex ones. Mathematics is mathematics, after all.

Achilles flips the coin with theatrical confidence.

It spins, descends gracefully… and lands perfectly upright on its edge, balanced like a tiny monument to impossibility.

Tortoise: (after a long pause) Well. That’s not very binary of it.

Achilles: (speechless, then sputtering) But… but this is mathematically preposterous! Coins don’t do this!

Crab: (circling the defiant coin) Apparently this particular coin hasn’t read your probability textbook.

II.

Crab: (tapping the table beside the rebellious coin) Your binary model has encountered a ternary reality.

Achilles: (frantically consulting his tablet) This is statistically impossible! A probability so close to zero it might as well be zero!

Tortoise: And yet here it stands, your zero-probability event occurring with stubbornly undeniable certainty.

Achilles: (desperately) It’s a fluke! An aberration! A one-in-abillion cosmic joke! The laws of physics haven’t been repealed just because one coin got confused!

Crab: (interrupting with sideways logic) Ah, but you didn’t flip a billion coins in a lab. You flipped one coin, one time, in reality. And reality, it seems, has a sense of humor about your probabilities.

Sloth: (emerging languidly from behind a potted fern) Models… assume… tomorrow’s… universe… operates… by yesterday’s… rules.

Achilles: Well, of course! That’s the foundation of all scientific prediction!

Tortoise: The coin has presented us with what statisticians call a “model failure”—an outcome that exists outside our framework of possibilities.

Achilles: (staring at the coin with growing horror) But if my binary model fails for something as simple as a coin flip, then… then…

Crab: (gently) Then perhaps your forty-three-factor market model might have a few blind spots?

III.

Achilles: (desperately examining the coin from multiple angles) There must be a rational explanation! Perhaps there’s an imperceptible table tilt, a localized magnetic anomaly, or some quantum interference pattern…

Tortoise: (amused) You’re retrofitting explanations to salvage your worldview rather than updating your worldview to accommodate inconvenient evidence.

Crab: The classic gambler’s fallacy in reverse. Instead of changing your bets when you lose, you’re changing reality to preserve your betting system.

Achilles: I’m not changing reality! I’m uncovering the hidden variables that explain apparent anomalies!

Sloth: (with drowsy wisdom) Hidden… variables… are… often… just… visible… humility… in… disguise.

Achilles: (frantically scribbling equations) Look! If I incorporate edge-landing probability as a third variable, adjust for microgravitational fluctuations, account for molecular surface tension effects…

Tortoise: (watching with fascination) Observe how quickly certainty transforms into increasingly elaborate uncertainty. Your simple binary model is becoming a hydra of complexity.

Crab: Each new variable you add creates three more questions. Soon, you’ll need a model to model your model.

Achilles: (looking up from his calculations, disheveled) But that’s… that’s exactly what I’m doing. I’m building a meta-model to explain why my original model failed to predict its own failure to predict…

Tortoise: (with gentle satisfaction) You’ve discovered recursive model uncertainty. The deeper you dig into explaining the unexplainable, the more unexplainable your explanations become.

IV.

Achilles: (staring at the defiant coin in dawning horror) If coins can spontaneously develop tertiary landing preferences, then anything unprecedented could manifest without warning!

Tortoise: (pleased) Now you’re beginning to grasp the delicious enormity of the problem.

Crab: Consider the sideways implications: how many other “impossible” market behaviors are absent from your model simply because they’re patiently waiting for their debut performance?

Achilles: (pale) There could be entirely new species of crashes… novel varieties of bubbles… correlation patterns that emerge ex nihilo…

Sloth: (with uncharacteristic clarity) The rarest… events… often… cast… the longest… shadows.

Achilles: (frantically updating his tablet) I need to expand my model! Account for previously unaccounted variables! Build in provisions for the unprecedented!

Tortoise: Your comprehensive model prepared you exquisitely for every financial apocalypse that had already occurred, but left you naked before the maiden voyage of a fresh catastrophe.

Achilles: (weakly) But how does one model the previously unmodeled?

Crab: (with philosophical precision) One doesn’t. One simply accepts that every model is an elegant confession of ignorance about what it fails to include.

Achilles: So my fifty years of backtesting, my seventeen asset classes, my forty-three factors… they’re all just sophisticated ways of preparing for battles that have already been fought?

Tortoise: (nodding) While tomorrow’s battle might be fought with weapons that haven’t been invented yet, on terrain that doesn’t exist today, according to rules that no one has written.

V.

Tortoise: (leaning back thoughtfully) Consider this paradox, my quantitatively-minded friend: the more comprehensive your model becomes, the more seductively it whispers that you’ve captured all possible futures in your mathematical net.

Achilles: (defensively) Well, yes, that’s rather the point of comprehensive modeling.

Tortoise: But confidence born of comprehensiveness might be the most expensive cognitive bias of all.

Crab: (tapping the table) Your perfectly predictive model couldn’t predict the limits of its own predictive perfection.

Sloth: (with drowsy profundity) The most… dangerous… models… work… flawlessly… right up… until… the moment… they… catastrophically… don’t.

Achilles: (gesturing helplessly at his tablet) So what am I supposed to do? Abandon quantitative analysis? Embrace financial mysticism?

Tortoise: Certainly not. But perhaps treat your mathematical masterpieces as useful approximations rather than divine revelations.

Crab: Models are maps, not territories. And occasionally, the territory sprouts cliffs that appear on no existing map.

Achilles: (with dawning realization) Like that coin. My probability map showed only two destinations, but the territory contained a third.

Tortoise: (pleased) Precisely. The question isn’t whether your maps are wrong—all maps are wrong. The question is whether they’re useful despite being wrong, and whether you remember they’re maps.

VI.

Achilles: (realizing) This happens in investing all the time, doesn’t it? Events that weren’t supposed to be possible…

Tortoise: Indeed. How many “six-sigma” events have occurred in markets over the past few decades?

Achilles: Too many to count. But we called them outliers, anomalies, once-in-a-lifetime events…

Crab: Even when they kept happening every few years.

Sloth: (softly) Perhaps… the outliers… are trying… to tell us… something… about our… inliers.

Tortoise: That our models systematically underestimate the probability of outcomes that fall outside their scope.

Achilles: (staring at his tablet) So all these backtests, all these statistical models… they’re just sophisticated ways of fighting the last war?

Crab: They’re useful for understanding what has happened. Less useful for predicting what’s never happened before.

Achilles: (with growing humility) And the most dangerous moments are when I’m most confident in my model’s completeness.

Tortoise: (with satisfaction) Now you’re thinking like someone who understands that the map is not the territory, and that the territory has a mischievous tendency to redraw itself when no one is looking.

VII.

Achilles: (after a long contemplation of the sideways coin) I came here to demonstrate the elegance of probability theory, and instead discovered the probability of elegance breaking down.

Tortoise: The coin has taught us something profound about the nature of prediction itself.

Achilles: What’s that?

Tortoise: That the most important outcomes are often the ones we haven’t thought to predict.

Crab: And that certainty about the future is usually inversely related to actual knowledge about the future.

Achilles: (looking at the still-balanced coin) So I should expect the unexpected?

Tortoise: You should expect that the unexpected is always possible, even when—especially when—your models suggest otherwise.

Sloth: (with final wisdom) The wisest… investors… are those… who build… portfolios… that benefit… from being… wrong… about things… they can’t… predict.

Achilles: (with newfound humility) Like position sizing small enough that even a sideways coin can’t destroy you?

Crab: (with approval) Exactly. When you can’t predict the direction, at least control the magnitude.

Tortoise: (as they prepare to leave) The coin will remain balanced for as long as it chooses to remain balanced. We cannot predict when it will fall, or which way. But we can appreciate that it has taught us the most valuable lesson of all.

Achilles: Which is?

Tortoise: That wisdom begins with admitting the limits of our wisdom and that those limits are closer than we think.

The coin continues to balance impossibly as they leave, a small monument to the beautiful impossibility of complete knowledge and the infinite creativity of an universe that refuses to be fully modeled.

Oddly, as a kid, the younger brother (Jamie) of a close friend would always ask for "sides" along with whether he called for heads or tails. And then one day, the coin actually did land on its side for him. We were all dumbfounded. The group concluded (wrongly I believe) that Jamie was undeservedly lucky, for that coin flip and some other reasons.

I give Jamie more credit for the chutzpah of asking for sides, dumb as it seemed at the time. ;)

Also, thanks for this piece. As one who has made many models over the last 40 years, and has made his share of mistakes, we have to approach the subject with humility, and anytime a result seems too promising, we need to be extra careful.

this held so much- humor, wisdom, poetry... and also somehow gave me hope in a difficult time. Thank you