We recently welcomed Acumen founder and CEO Jacqueline Novogratz to Infinite Loops (the episode will be dropping in your feeds tomorrow, 29 February). Jacqueline and Jim have a wonderfully wide-ranging discussion on creating a high-trust society, defining win-win, the difference between moral righteousness and moral leadership, and much more. Don’t miss it!

“Give a man a fish, and you feed him for a day. Teach a man to fish, and you feed him for a lifetime. Empower a man how to start a fishery, and he can feed a community.”

- Someone, somewhere, probably

Acumen’s origins have become the stuff of legend.

Smarting from the unkind comments of one of her peers, the teenage Jacqueline Novogratz donates her once-beloved blue sweater to Goodwill.

Eleven years later, she is in Rwanda, a dewey-eyed idealist trying to change the world for the better. She spots something - a young boy wearing a distinctive blue sweater. Surely not? She approaches the boy and, despite neither of them speaking the other’s language, manages to take a look at the jumper’s label.

There, she recognises the distinctive scrawl of her own handwriting.

It’s the same jumper.

Decades later, in her best-selling memoir, The Blue Sweater, Jacqueline describes how this remarkable coincidence fundamentally shaped the way she thinks about the world:

“The story of the blue sweater has always reminded me of how we are all connected. Our actions--and inaction--touch people we may never know and never meet across the globe. The story of the blue sweater is also my personal story: Seeing my sweater on that child renewed my sense of purpose in Africa. At that point in my own journey, my worldview was shifting. I'd begun my career as an international banker, discovering the power of capital, of markets, and of politics, as well as how the poor are so often excluded from all three. I wanted to understand better what stands between poverty and wealth.”

Today, Jacqueline’s record speaks for itself. Not only is she a best-selling author, nonprofit board member, public speaker and Foreign Policy Top 100 Global Thinker, but the nonprofit fund she founded and leads to this day, Acumen, has invested more than $154 million in 167 companies globally. Its website states that it has impacted over half a billion lives.

Acumen isn’t your everyday charity. Its approach to philanthropy, which Jacqueline developed through hard experience in Rwanda, Latin America and elsewhere, seeks to do nothing less than change the way the world tackles poverty. By harnessing the best impulses of both the market and philanthropy, it aims to create an impact optimised for dignity, not dependency; prosperity, not profit.

Let’s dive in.

The Opposite of Poverty

What’s the opposite of poverty?

For some, the default answer is “money” or “income.”

Jacqueline disagrees: “if the problem were simply the case of income, we could fix it by giving the poor some extra money and be done with it.”

No, solving poverty requires something more fundamental. To truly be free from its tendrils, one must be granted dignity:

“The opposite of poverty is dignity.

Dignity is freedom. It is choice. It is having control over decisions in our lives.

Dignity is the most fundamental of our yearnings — to be seen, to be counted, to be free. It is this indomitable spirit that binds us as human beings, that is most fundamental to our humanity. Defining our success not by the income we amass but by the dignity we cultivate — in ourselves and others — thus presents the greatest hope for the future of our species and our planet.”

If dignity is the goal, then any charitable approach that creates dependency is misguided, no matter how well-intentioned. In tomorrow’s episode, Jacqueline tells us how her time in Rwanda led her to believe that traditional charitable giving has just this effect:

“this was an era of a lot of top-down aid, charity, government assistance that was creating dependency, which is the opposite of dignity.”

Jacqueline believes that philanthropy should treat those it aims to support as autonomous partners with desires of their own rather than passive recipients of aid.

Risky Business

If charity creates dependency, then perhaps the forces of market capitalism are more empowering?

Here, too, Jacqueline identifies a problem.

Markets are a powerful force for lifting people out of poverty. However, left unbridled, they lead to “the exploitation of people and planet in the name of shareholder returns and short-term financial growth.”

By optimising for shareholder value, markets can fail to address essential human needs such as access to clean water, healthcare, education, and affordable housing, as these areas might not offer immediate or substantial financial returns.

With its focus on financial growth, market capitalism has a specific set of expectations around risk management, viability and timescales. This does not always align well with the needs of the world’s most impoverished regions, defined often by corruption, lack of infrastructure, and an absence of consumer trust. As a result, significant investment tends to bypass these areas, diminishing their prospects for development and creating a vicious cycle that further discourages investment.

This mismatch between the mechanisms of market capitalism and the needs of underdeveloped regions underscores the necessity for a more nuanced approach that balances financial returns with social impact.

The Third Way

Founded in 2001, Acumen aims to thread the needle between philanthropy and the market by investing directly in companies and change makers in the developing world.

The common thread of its diverse range of investments is, that word again, dignity. Whether an agricultural aggregator in Colombia or an e-mobility company in East Africa, the ultimate products and services of Acumen’s investments must enable, in some way, users to transform their lives.

Think of it as a “venture capital fund for the poor,” harnessing the power of venture investing while embracing philanthropy’s freedom from short-term financial calculus. It’s a dignity deployment mechanism, a way to give entrepreneurs on the ground the resources and the time they need to build sustainable, impactful businesses that can revolutionise their customers’ lives.

Have a Little Patience

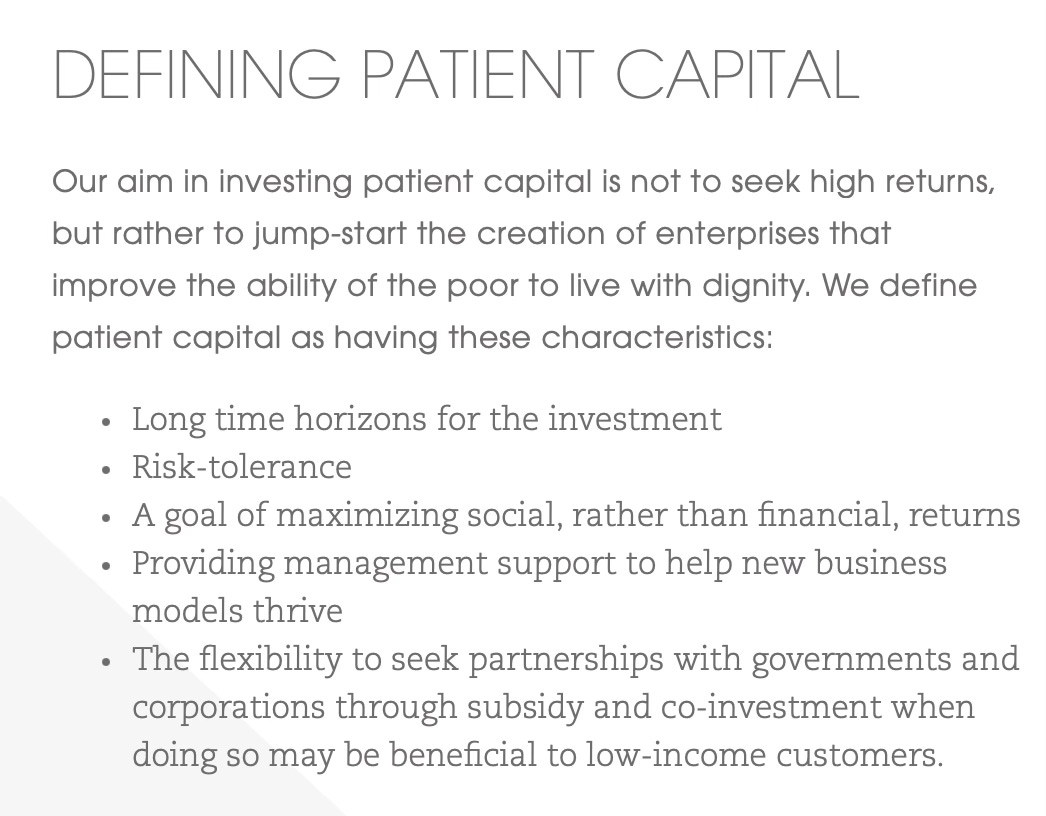

For over 20 years, Acumen’s weapon of choice has been “patient capital,” a funding method that aims to “bridge the gap between the efficiency and scale of market-based approaches and the social impact of pure philanthropy.”

Put simply, patient capital is a debt or equity investment in a socially beneficial early-stage business. The goal isn’t return ON capital; it’s return OF capital (i.e. 1x return). That one-letter difference means a lot. The expectation of a 1x return operates as an accountability metric. However, by focusing on maximising *social* rather than *financial* returns, patient capital’s risk tolerance is high, allowing Acumen to invest in. businesses deemed unrealistic under the traditional venture model.

At the heart of patient capital lies, yep, you guessed it, patience. It takes a long time and a lot of work to revolutionise an industry, particularly in the regions where Acumen primarily operates. The investment time horizons are long, and they’re getting longer. Jacqueline told us, “At the time, we thought patient capital was seven to 10 years. I have since learned that disrupting entire industries or building new ones altogether can take 10 to 20 years.”

Buddy Up!

Acumen aims to leverage its position on the threshold of business and philanthropy to reverse-engineer sustainability in the developed world. Provided that the counterparty has “an explicit commitment to sustainable and inclusive business practices,” Acumen partners with carefully curated corporate partners to help bridge the gap between large corporations and social enterprises embedded in local communities:

By the People; For the People

As Acumen has evolved, so have its practices. In tomorrow’s episode, Jacqueline tells us how Acumen is increasingly leaning into its people-first model of change:

“Acumen's theory of change starts with people. And we've actually grown from the model I just talked to you about to one where we have an academy that teaches young entrepreneurial leaders operational financial skills and what we call the moral imagination. From that, we hope that some of those entrepreneurs will go and get invested in with our patient capital, and then we've got about 300 million that we're managing in the for-profit space. And then it's take the insights, take the lessons, and share it with the world.”

Launched in 2020, Acumen Academy aims to “unleash a new generation of social innovators and leaders with the determination and grit to build a more just, inclusive and sustainable world.” Offering fellowships, accelerators and online courses, it hopes to become “the world’s school for social change. A university re-imagined for a world that needs all of us.”

Find the right people, build trust, empower them, and unleash them on the world. Sound familiar?

Success

Acumen’s website claims it has impacted over half a billion cumulative lives through $154m invested in 167 social enterprises across South Asia, Latin America, Africa and the United States.

It’s easy to get lost in the numbers. Just as powerful are the stories, from providing ambulances in India to offering solar solutions to millions without access to reliable energy (Jacqueline walks us through some more powerful examples in tomorrow’s episode).

So, what’s next?

Well, I don’t want to spoil too much of tomorrow’s episode.

Suffice to say, Jacqueline’s ambition and determination are only growing:

“To give people who are fundamentally left out of opportunity that first rung, it's going to be really, really difficult.

And I'm in that camp of people who do things because they're difficult.

And so I'm very, very excited by that.”

We do hope you tune in this week. You might just find that you finish the episode with a transformative idea of your own.

See you tomorrow!

Yes! Love it! Thanks!