5 VC Elephants in the Room

Demystifying Venture Capital #03: analyzing venture capital stereotypes and how OSV is pioneering change

Author’s Note: This essay is part 3 of a 4 part series titled Demystifying Venture Capital. You can read part 1 here: The Origin Story of Venture Capital, and part 2 here: Inside the Creator Economy.

“Silicon Valley is gripped by the cult of the individual. But those individuals represent the triumph of the network.”

– Matt Clifford

The great paradox of stereotypes is that they simultaneously stem from truth and ignorance alike.

Take the myth that all writers are starving artists with addiction issues; or that all chefs throw plates at their employees in fits of rage. Take the myth that all librarians are old women who love cats; or that all venture capitalists dress the same and thirst for money like Roman gladiators for blood.

There’s no denying that some of these stereotypes are true. There have been, for instance, plenty of money-hungry VCs who try to take advantage of young entrepreneurs just to cushion their own bank accounts. The industry is far from perfect.

But when VC is done correctly, in its purest form, it can be a transformative and incredibly positive experience for companies and creators.

This is why O’Shaughnessy Ventures (OSV) is doing things differently.

We’re looking to capture the essence of venture capital (all of the good, none of the bad) and do away with harmful stereotypes. By empowering creators with knowledge and resources, we’re ensuring creators feel qualified to make their own decisions about what’s right for them when it comes to this industry.

Essentially, there is a gap between what VC is actually like and what VC should be like.

Here’s what you need to know (and here’s how we’re bridging that gap).

Stereotype #1: Any ole’ investor will do

Imagine you’re sitting in a job interview.

You ask questions about the company culture, the benefits, the PTO. You want to know what the day-to-day looks like. You want to make sure the company is feeding into you as much as you’re feeding into it. Salary is only one facet of the conversation.

It will always be a red flag if a VC is only trying to sell you on funding. Investors are not just bringing funding to the table; but consultation, hands-on mentorship, resources, and network. When done right, it’s like holding a giant megaphone up to your startup and shouting “I’ve arrived!” to the world.

This means entrepreneurs are rewarded for being as choosy as possible; for intentionally seeking out investors who share their values and back their vision.

If an author wants to publish their romance novel, they’re not going to look for a literary agent who represents sci-fi writers. They’re going to double down on finding agents with an insatiable love for romance and a strong portfolio of working with similar writers.

For entrepreneurs seeking funding, there are firms that specialize in crypto, consumer technologies, or creatives (hi, we’re OSV, it’s nice to meet you).

The best VCs are niche-specific and deeply rooted in their industry.

Finding the right investor – one who wholeheartedly supports the heart and soul of your business – is what allows the relationship to thrive.

Alas, this is not a one-size-fits all business. But it is not supposed to be.

Stereotype #2: VC is bad for small businesses

Sometimes, VCs really do only want more money and more control.

When this is the case, yes – venture capital is bad for small businesses. VCs will fund a young, promising startup, and as it begins to scale, they will seize more control of the company until they can squeeze the founder out completely.

But when done right, VC can fill all of the gaps that small businesses cannot fill on their own. Whether that’s funding, marketing, or networking (the list goes on) VC can step in to fill those gaps, supporting small businesses to get up and go, find their groove, and exceed their own expectations.

Considering creators are the new small businesses of America, supporting small businesses is exactly what OSV is setting out to do.

As Jim O’Shaughnessy says, we’re trying to help creators and startups “put gas in the car.” But it may be more like jet fuel. The pulse of VC is helping young, scalable, still-raw companies take flight. So, expect just that: a launch.

Stereotype #3: VC’s don’t have your best interest in mind

Think of the most demanding coach you’ve ever had.

The more they yell at you in practice, the more potential they see in you. They know what you’re capable of; they know how good you can be; and they’re just trying to help you tap into that inner place of genius.

Venture capitalists are like that…except they’ve bet millions of dollars on you.

And just like bad coaches react to poor player performance, bad VCs can go from being your best friend to turning on you if you miss a milestone or an earnings number.

The best VCs, however, are committed to unlocking your inner place of genius. They’re good coaches. They know what you’re capable of and how good you can be. They’ve put you in their starting five, and now, they expect you to perform like a superstar. When you mess up, they’re not going to let you hide – but they’re also going to do everything in their power to help you succeed.

I recently chatted with a former VC and Write of Passage alum – Latham Turner – who said this:

“The brilliance of venture capital is that it aligns everybody’s incentives. When your employees win, you win. When you win, your VC’s win. That’s what equity does.”

The goal is to find VCs who are invested beyond just the numbers. Yes, the scoreboard is important – but so is the development of the players.

This is, after all, a team sport.

Stereotype #4: VC isn’t *actually* innovative itself

Maxwell Perkins was an editor famous for discovering literary giants like Ernest Hemingway, F. Scott Fitzgerald, and Thomas Wolfe.

In the face of his impending fame, he said this:

“An editor at most releases energy. He creates nothing.”

Perkins didn’t pretend he was the smartest, most creative person in the room. He knew he wasn’t. That’s what made him so good.

Like Perkins, the best VCs don’t pretend they’re the smartest, most innovative people in the room. They know they aren’t.

In true Perkins fashion, Jim O’Shaughnessy says:

“As a VC, I am at best a co-creator. At best.”

The best VCs are going to recognize that you have a great idea, and they want to help you get there. So, they invest in industries, ideas, and startups who carry this innovation within them.

They are far less concerned with creating energy, and far more devoted to releasing it.

Stereotype #5: All venture capitalists dress the same

While mostly for my own amusement, this stereotype cannot be overlooked.

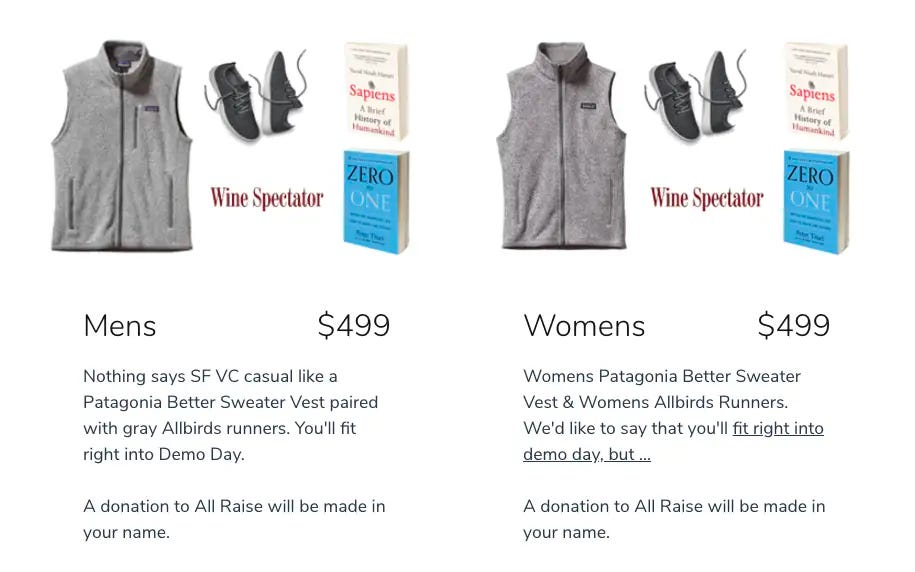

An actual website sells “VC starter packs” for aspiring venture capitalists, starring Patagonia vests and Allbird shoes.

These Silicon Valley staples ensure venture capitalists will be able to “signal their intellectualism” and “work ‘what important truth do very few people agree with you on?’” into every conversation.

Although I can't say for sure that a VC’s personal style indicates how good he or she is at their job, I can say that there are some pretty well-dressed VCs out there.

Take our very own Jim O’Shaughnessy:

Perhaps a subversion of the VC starter pack is a result of the industry leaning heavily into the spirit of individual flair (or maybe the lingering embarrassment from that website, who knows).

Only you can decide for yourself

Some of the white noise surrounding venture capital is rah rah! and some of it is less than desirable.

What we know for sure is that the best VCs will:

Be niche-specific

Add jet fuel to your business

Always have your best interest in mind

Be committed to releasing your energy

Will (maybe) have some semblance of personal style

But remember the great paradox of stereotypes. The important thing is that you decide for yourself. Again, this is not a one-size-fits-all business.

If you're a creator or entrepreneur hiding behind your Plan B or Plan C – dreaming of an opportunity to pursue your Plan A – who knows?

This might just be the window of opportunity you’ve been looking for.

Thanks for reading this week’s edition of “Demystifying Venture Capital.” Our fourth and final (and favorite!) essay comes out next week – an ode to the personal life lessons of Jim O’Shaughnessy himself. You don’t want to miss it.

Photo of Jim actually made me laugh out loud -- great t-shirt! People can't forget your name, I need to get a Liberty t-shirt 🤔